Today’s Hims Daily is brought to you by … Godel Terminal

People have tried to build a “Bloomberg killer” for years. Godel might actually pull it off. They’re just getting started, but what they’ve already built delivers 90% of Bloomberg’s functionality at 10% of the price. It’s a full trading terminal for $80/month.

We use it daily to track short interest, institutional ownership, analyst ratings, and earnings estimates. If you want access to the data powering Hims House (and a lot more) this is it. Sign up today to lock in lifetime access for $80/mo. First month just $60 if you sign up through Hims House 🔥

Stock Price: $49.86

Today: +$0.45 (+0.91%)

YTD: +$25.68 (+106.20%)

Q2: +$20.31 (+68.73%)

🚨 We dropped a new Hims Data Tracker late last week. Sales are gaining steam into the end of Q2. Upgrade to paid for access!

What’s Happening

Flat finish after early whipsaw. HIMS dipped on the open, but recovered to close barely green — a somewhat disappointing day given the broader indices were all green and stocks like HOOD jumped around +13%.

Volume cools off. Just 34M shares traded (20% below average), signaling lighter conviction and probably some profit taking after the bounce back last week.

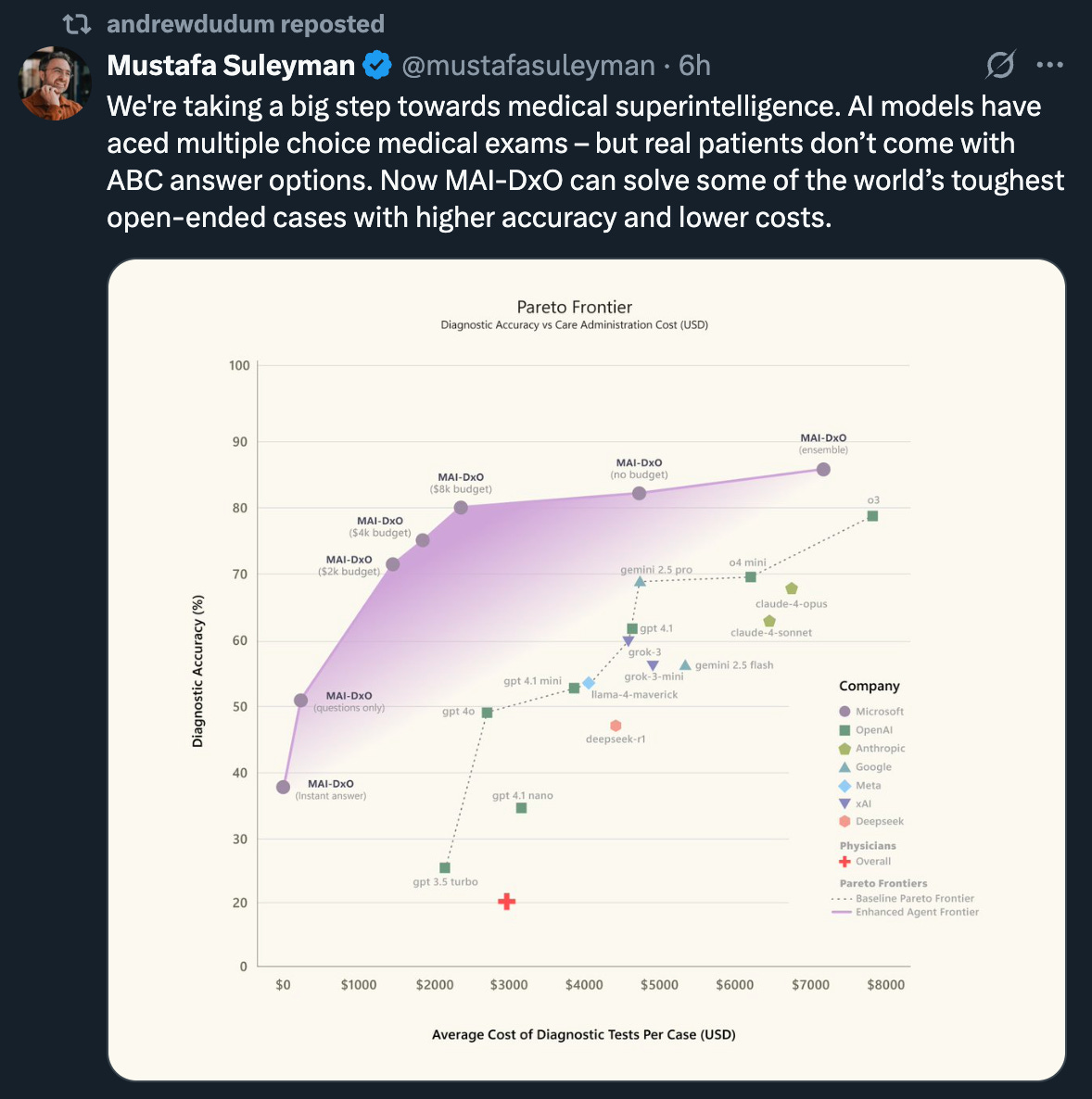

Hims CEO Andrew Dudum retweeted a post from Mustafa Suleyman, CEO of Microsoft AI and previously co-founder of Google’s DeepMind.

The TLDR is that Microsoft’s MAI-DxO is obliterating all of the benchmarks in medical AI. Built to simulate a collaborative panel of AI “agents” acting like virtual physicians, MAI-DxO was tested on 304 of the most diagnostically complex cases from the New England Journal of Medicine. It achieved an 85.5% solve rate—blowing past both human doctors (who typically score around a 20% solve rate) and other LLMs—while also reducing the total cost of diagnostic testing.

The system can operate under real-world budget constraints and uses a deliberative chain-of-thought approach to optimize both accuracy and cost.

Many investors see Andrew’s retweet as a glimpse into Hims’ long-term vision, a shift from static intake forms to AI-driven diagnosis and treatment. It’s not about today, but where Hims might be headed 🔥

Narrative tug-of-war intensifies. Bulls point to Goldman’s +45% stake increase and the hire of ex-Robinhood VP, Dheerja Kaur; bears are highlighting litigation risk from Novo as well as App Store weakness.

Morgan Stanley reiterated its $40 price target and HOLD rating.

South Korea inflows hit record. Hims jumped to #30 on Korea’s Top 50 ETF list, with $36M in inflows—the highest level we've observed to date. A sign of rising global interest and potential passive tailwinds.

The Kalshi market we talked about on Friday just went live.

Currently bettors are putting the risk of a lawsuit at 46%. The market has seen just $4.3k in trading volume so far.

Catalysts

Any legal filings from Novo Nordisk or Hims

Lingo CGMs or other wearable partnerships?

More acquisitions still to come?

Move from the Russell 2000 to the Russell 1000 could drive institutional buying. Index reconstitution set for late June.

Pharma tariffs?

Partnership with Eli LillyAny incremental details on the Novo Nordisk roadmap