Today’s Hims Daily is brought to you by … Godel Terminal

People have tried to build a “Bloomberg killer” for years. Godel might actually pull it off. They’re just getting started, but what they’ve already built delivers 90% of Bloomberg’s functionality at 10% of the price. It’s a full trading terminal for $80/month.

We use it daily to track short interest, institutional ownership, analyst ratings, and earnings estimates. If you want access to the data powering Hims House (and a lot more) this is it. Sign up today to lock in lifetime access for $80/mo. First month just $60 if you sign up through Hims House 🔥

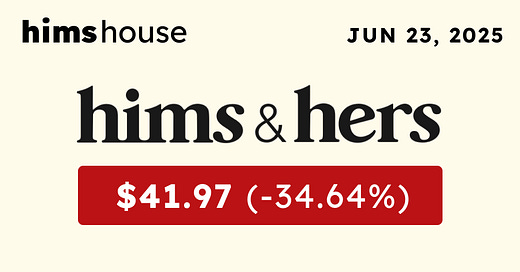

Stock Price: $41.97

Today: -$22.25 (-34.64%)

YTD: +$17.79 (+73.59%)

Q2: +$12.42 (+42.05%)

🚨 Despite the Novo news, Hims Q2 earnings setup continues to improve, as we showed on last week’s HIMS DATA TRACKER… Upgrade to paid for access!

What’s Happening

HIMS PLUNGES -35% AFTER NOVO NORDISK TERMINATES LONG-TERM COLLABORATION. Novo issued a surprise pre-market press release accusing Hims of “illegal mass compounding” and “deceptive marketing,” ending the branded Wegovy supply deal just eight weeks after launch and sparking fears of litigation and regulatory action.

Shares promptly collapsed from $64 to the low $40s on record volume. 165M+ shares were traded on the day.

Short sellers doubled down literally all day. Data from Interactive Brokers shows that shares available to short went from 4M to start the day down to below 2M by late afternoon.

To make matters worse from a technical perspective, shares closed essentially at essentially the low of the day.

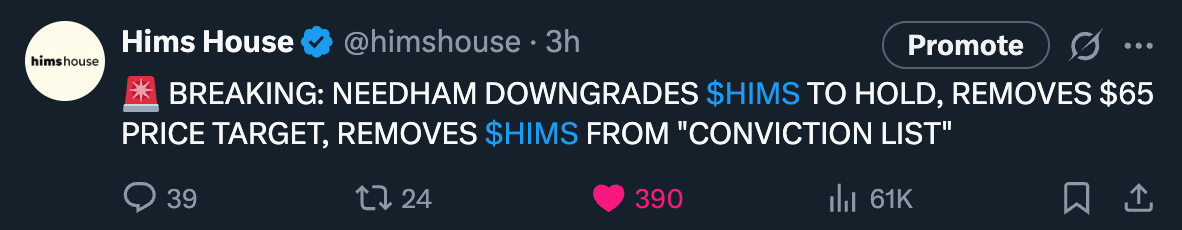

Legal overhang now central risk. Analysts shifted focus to a potential lawsuit from Novo Nordisk. Needham downgraded the stock to Hold, pulled its price target, and removed HIMS from its Conviction List; while Citi reiterated its Sell rating and $30 PT, warning of "substantially higher legal risk."

CEO Andrew Dudum fired back on Twitter, calling Novo’s claims “misleading” and “anticompetitive,” alleging Novo pressured Hims to push branded Wegovy over compounded alternatives. No financial filings or press release followed, leaving markets and investors trading on uncertainty.

API sourcing controversy intensifies. As we noted on Twitter, a former HIMS pharmacy VP claimed on an expert call that their semaglutide API comes from “the same place Novo uses.”

Meanwhile, on its annual letter to shareholders, Novo says its API sites are exclusively in Denmark and the U.S., not China — directly contradicting former Hims VP’s claim and muddying the narrative further.

Our episode with Adam May will drop later this afternoon 👀

Catalysts

Any legal filings from Novo Nordisk or Hims

Short interest data tomorrow

Lingo CGMs or other wearable partnerships?

More acquisitions still to come?

Move from the Russell 2000 to the Russell 1000 could drive institutional buying. Index reconstitution set for late June.

Pharma tariffs?

Partnership with Eli LillyAny incremental details on the Novo Nordisk roadmap