Today’s Hims Daily is brought to you by … Godel Terminal

People have tried to build a “Bloomberg killer” for years. Godel might actually pull it off. They’re just getting started, but what they’ve already built delivers 90% of Bloomberg’s functionality at 10% of the price. It’s a full trading terminal for $80/month.

We use it daily to track short interest, institutional ownership, analyst ratings, and earnings estimates. If you want access to the data powering Hims House (and a lot more) this is it. Sign up today to lock in lifetime access for $80/mo. First month just $60 if you sign up through Hims House 🔥

Stock Price: $61.10

Today: +$1.86 (+3.15%)

YTD: +$36.92 (+152.71%)

Q2: +$31.55 (+106.78%)

🚨 STARTING THIS WEEK - we’re including weekly web traffic and app activity in our Hims Data Tracker. Upgrade to paid for access!

What’s Happening

HIMS closes +3% after wild session. Shares traded in a wide $58-$62.50 range (7.5% swing) before settling just above $61. Today was our first close above $61 since May 20 🤯

Volume hit 43M, well above the 90-day average, signaling conviction-driven buying

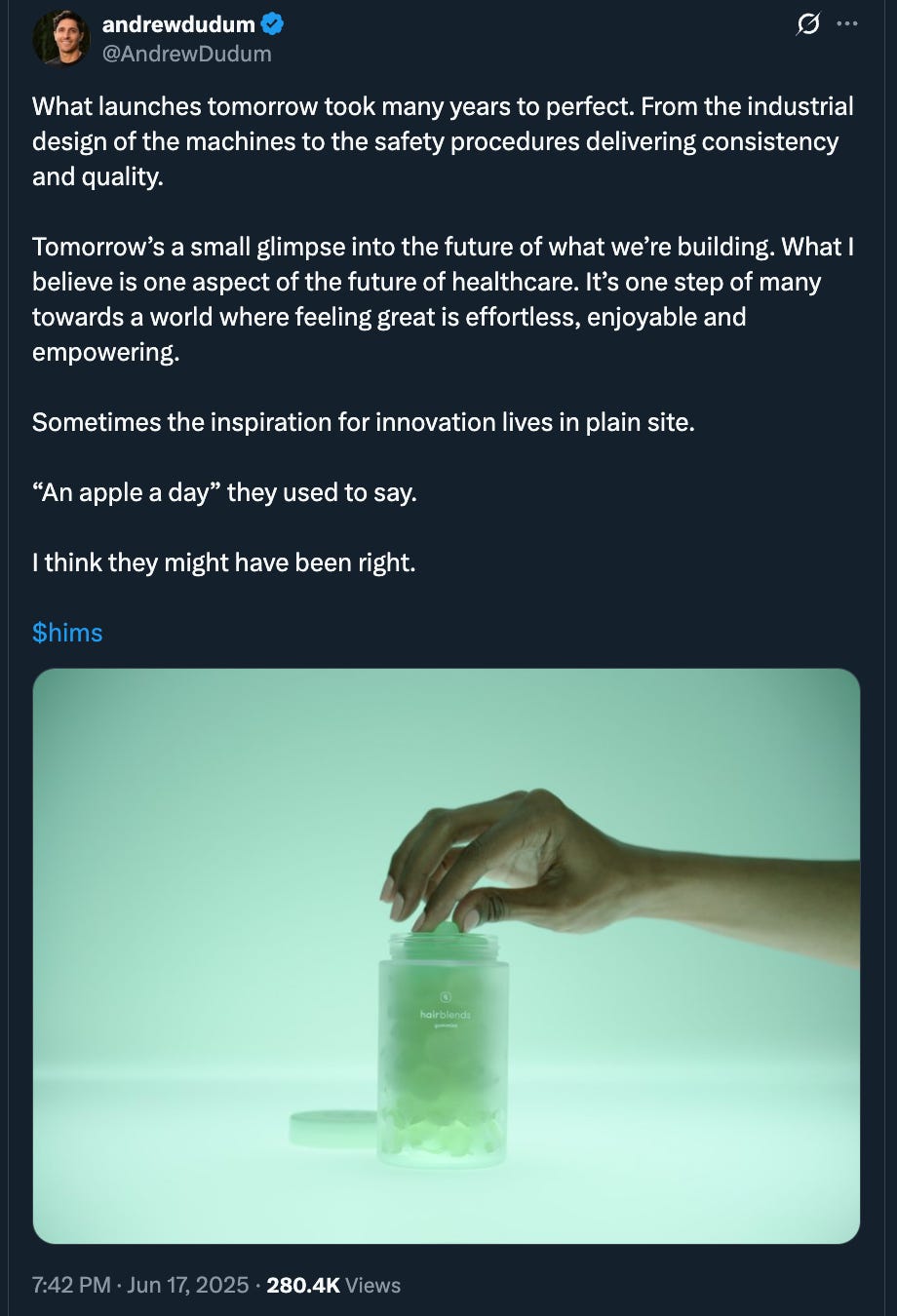

HERS LAUNCHES FIRST PRESCRIPITION HAIR-REGROWTH GUMMY. The Biotin + Minoxidil gummy officially dropped today, marking a first-of-its-kind format and a milestone for Hims’ personalized gummy platform. CEO Andrew Dudum framed the product as “a small glimpse into the future of healthcare,” hinting at broader ambitions across sleep, hormonal health, and more 🔥

Sentiment shifting from hype to platform thesis. While certain bears rolled their eyes, the vast majority of investors noted the precision of the gummy launch video and packaging, calling it a brand-defining moment. Bulls likened the rollout to a tech-style product reveal and framed it as a signal for how Hims could approach larger verticals like TRT. BULLISH.

Gummy TAM draws investor focus. Multiple analyst firms expect the supplement gummy market to grow to $40-50B over the next few years, underscoring their potential beyond hair regrowth. Hims' in-house capabilities and sleek branding position it well.

Q2 tracking ahead of consensus. Credit card data shows +70% YoY growth in observed Q2 sales (via Bloomberg Second Measure), ahead of Wall Street’s +62% consensus.

We’ll have a full breakdown on Friday in our HIMS DATA TRACKER

Macro backdrop: mixed but manageable. The Fed held rates steady, supporting growth names. But lingering Israel-Iran tensions added some caution to an otherwise risk-on day.

Catalysts

Lingo CGMs or other wearable partnerships?

More acquisitions still to come?

Move from the Russell 2000 to the Russell 1000 could drive institutional buying. Index reconstitution set for late June.

Pharma tariffs?

Partnership with Eli LillyAny incremental details on the Novo Nordisk roadmap

Upcoming OFA vs. FDA case on semaglutide