Today’s Hims Daily is brought to you by … Godel Terminal

People have tried to build a “Bloomberg killer” for years. Godel might actually pull it off. They’re just getting started, but what they’ve already built delivers 90% of Bloomberg’s functionality at 10% of the price — a full trading terminal for $80/month. And if you sign up through Hims House, your first month is just $60.

Hims House runs on Godel. We use it daily to track short interest, institutional ownership, analyst ratings, and earnings estimates. If you want access to the data powering Hims House — and a lot more — this is it. Sign up today to lock in lifetime access for $80/mo. First month just $60 🔥

Stock Price: $55.50

Today: -$1.65 (-2.89%)

YTD: +$31.32 (+129.52%)

Q2: +$25.95 (+87.81%)

🚨 NEW Hims Data Tracker dropped today — the BIGGEST week so far in Q2. Upgrade to paid for access!

What’s Happening

Geopolitical shock tested support — HIMS held. Stock dropped to $54.67 on Israel-Iran headlines but clawed back to close -3% at $55.50

Despite all the news, volume was light. Just 25M shares traded (close to -40% below the average)

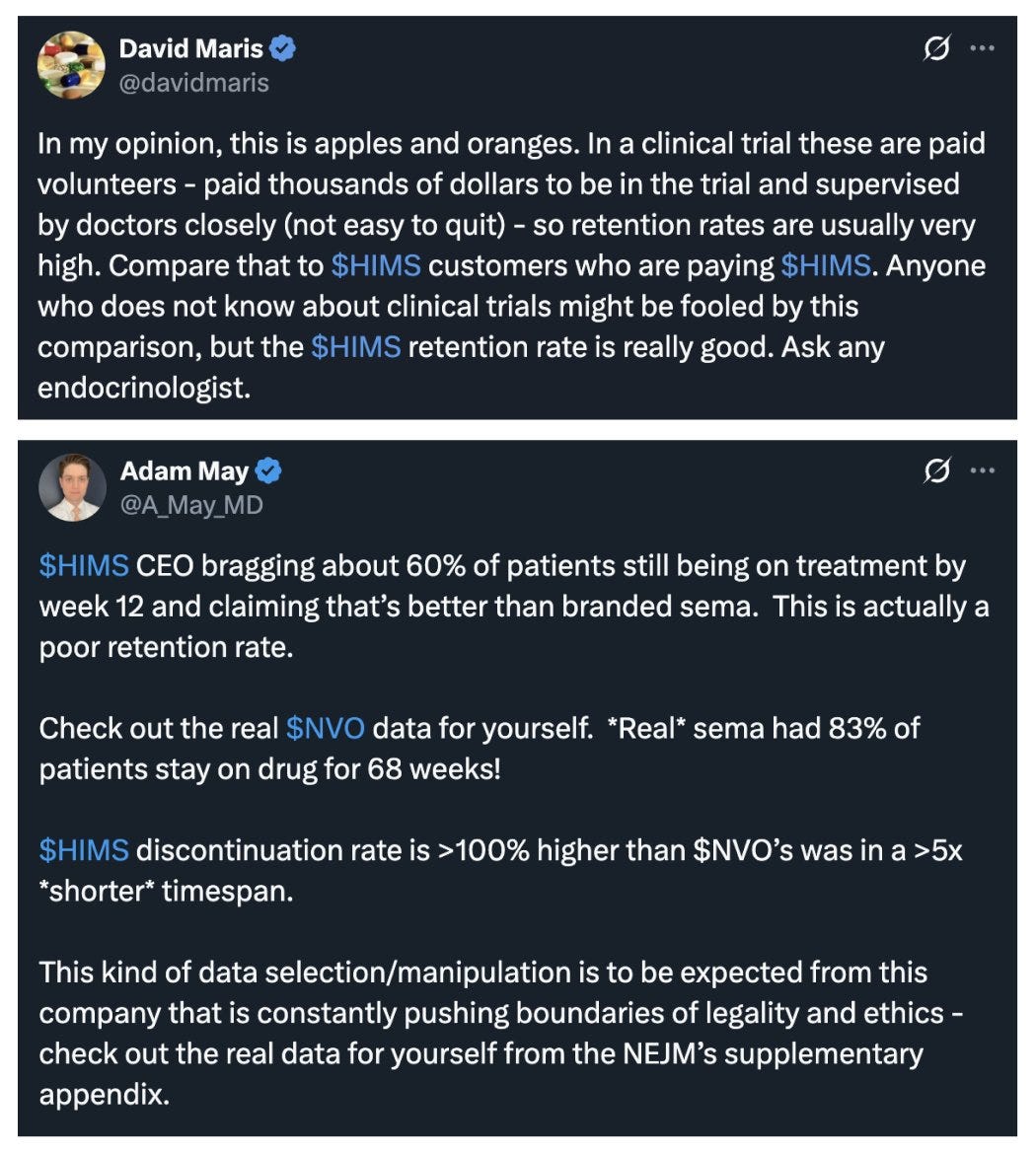

GLP-1 adherence data grabs headlines. CEO Andrew Dudum announced 60% 3-month retention across 90k GLP-1 patients—well above commercial benchmarks—plus 5% average weight loss in two months and 96% of patients reporting broader health benefits. Bulls framed it as validation of personalized dosing.

Critics argued the 60% figure underwhelms vs. Novo Nordisk’s 83% retention over 68 weeks, accusing HIMS of cherry-picking.

6x #1 ranked healthcare analyst David Maris retorted that HIMS’s real-world results are more impressive than tightly controlled trials.

Another Twitter account added: “Real-world Wegovy adherence is 40% and lower. Novo study adherence is inflated as patients are likely getting the medication for free and getting paid to participate”

Amazon health re-org underscores HIMS advantage. Amazon announced a healthcare shakeup, restructuring into six "pillars" after a wave of executive exits. Investors saw it as more evidence of strategic drift—and a boost to HIMS’s focus and execution in the DTC space.

The Data Tracker confirms HIMS just enjoyed its strongest week so far in Q2. Credit card sales surged, weight loss interest spiked, and ad volume ramped across both brands. The strength was broad-based and visible across every tracked signal except for app rankings.

Catalysts

More acquisitions still to come?

Move from the Russell 2000 to the Russell 1000 could drive institutional buying. Index reconstitution set for late June.

Pharma tariffs?

Partnership with Eli LillyAny incremental details on the Novo Nordisk roadmap

Upcoming OFA vs. FDA case on semaglutide