Today’s Hims Daily is brought to you by … Godel Terminal

People have tried to build a “Bloomberg killer” for years. Godel might actually pull it off. They’re just getting started, but what they’ve already built delivers 90% of Bloomberg’s functionality at 10% of the price — a full trading terminal for $80/month. And if you sign up through Hims House, your first month is just $60.

Hims House runs on Godel. We use it daily to track short interest, institutional ownership, analyst ratings, and earnings estimates. If you want access to the data powering Hims House — and a lot more — this is it. Sign up today to lock in lifetime access for $80/mo. First month just $60 🔥

Stock Price: $57.17

Today: -$0.40 (-0.69%)

YTD: +$32.99 (+136.41%)

Q2: +$27.62 (+93.45%)

🚨 NEW Q2 revenue prediction dropped today. New Hims Data Tracker tomorrow. Upgrade to paid for access!

What’s Happening

Early surge to $59.90 on Jefferies upgrade and soft PPI print. Jefferies DOUBLED its Hims price target from $25 to $50 pre-market, and cooler May PPI data (+0.1% vs. +0.3% est.) boosted rate-cut odds — fueling a +6% rally out of the gate.

Then the stock sold off violently, swooning back to the $56s before recovering and chopping between $57-58 for the rest of the day

Volume was just 34M, slightly below the 90-day average

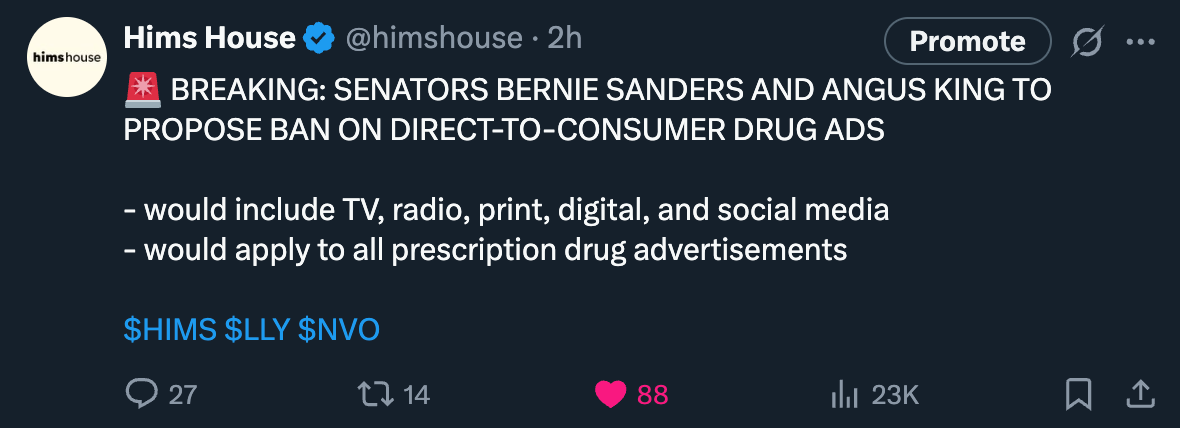

DTC ad-ban proposal. A WSJ report that Senators Bernie Sanders & Angus King will introduce a bill banning direct-to-consumer drug ads triggered a sharp as the trading algos reacted

In the Discord, Bayside eased the minds of certain “panicans,” highlighting political impracticality, First Amendment constitutional hurdles, and potential upside for Hims’s platform-based model.

Short-squeeze chatter still simmering as bulls eye $60 breakout. Debate focused on the 33% short interest, while July $90 calls saw fresh action; $60 remains the key technical hinge for a potential breakout toward new all-time highs.

Hims’ annual shareholder meeting is today at 2pm ET. Investors will vote on board elections, executive pay, and auditor ratification.

Catalysts

More acquisitions still to come?

Move from the Russell 2000 to the Russell 1000 could drive institutional buying. Index reconstitution set for late June.

Pharma tariffs?

Partnership with Eli LillyAny incremental details on the Novo Nordisk roadmap

Upcoming OFA vs. FDA case on semaglutide