Today’s Hims Daily is brought to you by … Godel Terminal

People have tried to build a “Bloomberg killer” for years. Godel might actually pull it off. They’re just getting started, but what they’ve already built delivers 90% of Bloomberg’s functionality at less than 10% of the price. It’s a full trading terminal for $80/month.

We use it daily to track short interest, institutional ownership, analyst ratings, and more. If you want access to the data powering Hims House, this is it. Sign up today to lock in lifetime access for $80/mo. First month just $60 if you click here to sign up 🔥

Stock Price: $51.18

Today: +$2.22 (+4.53%)

YTD: +$27.00 (+111.66%)

Q3: +$1.33 (+2.67%)

🚨 NEW Q2 Revenue Prediction + Hims Data Tracker drops later this week… Upgrade to paid for access!

What’s Happening

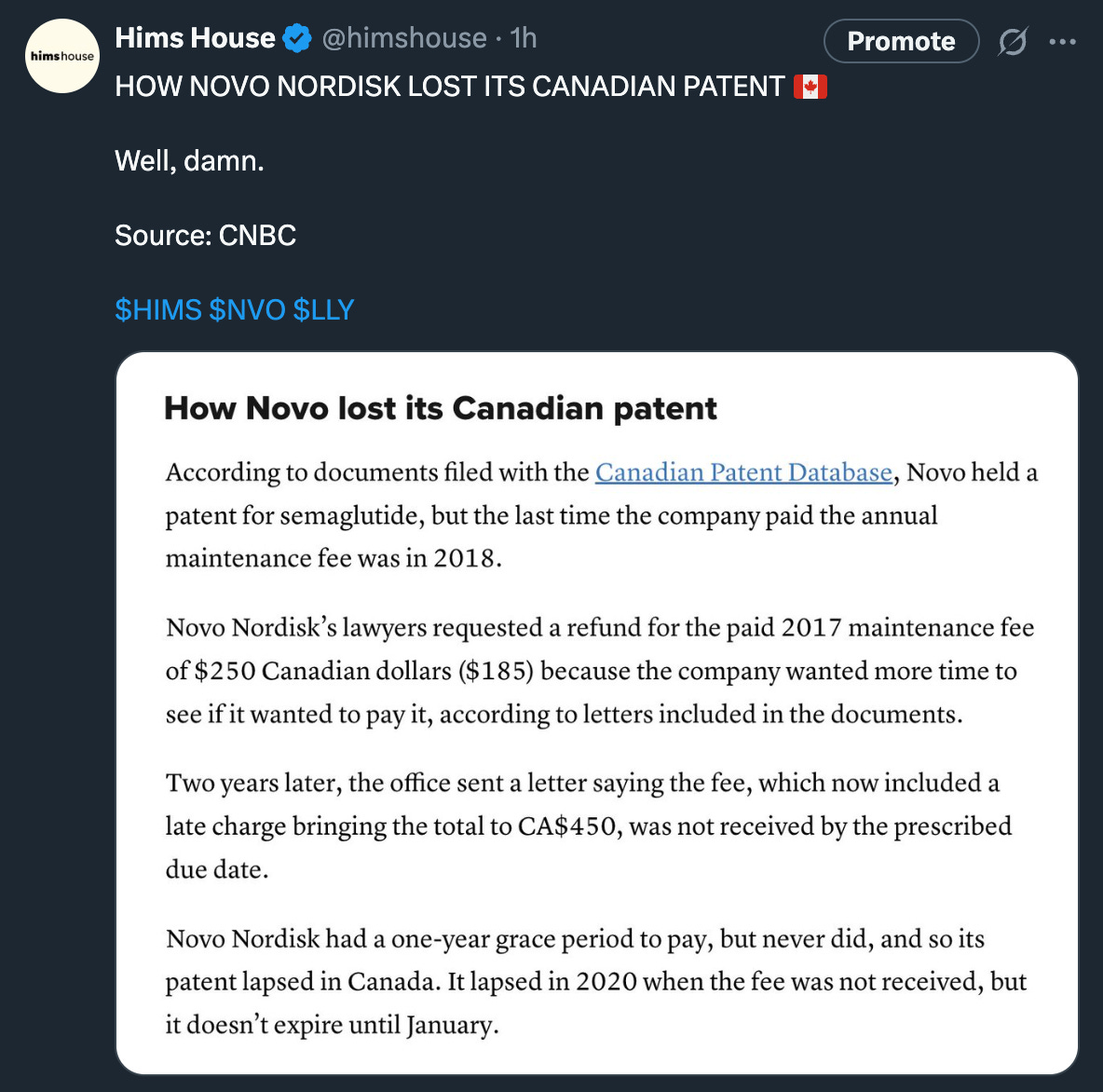

HIMS IS EXPANDING INTO CANADA, WILL SELL GENERIC SEMAGLUTIDE ONCE NOVO PATENT EXPIRES IN EARLY 2026 🇨🇦

Gap-up on the news, then wild intraday swing. Shares opened at $50.50 after a pre-market surge on the announcement that Hims is preparing to launch generic semaglutide in Canada in 2026. Shares spiked +7% out of the gate, flushed to $48.68, then clawed back to close at $51.18.

Volume was 38M — right on the 90-day avg

Canada boosts bull case, Citi throws cold water. CNBC pegged the Canadian semaglutide market at $1B+ today and $4B by 2035, in part fueled by Novo’s expiring patent. But Citi reiterated its Sell rating and $30 PT, helping spark the intraday pullback before dip-buyers stepped in.

Global expansion gains structure. Hims has appointed former ZAVA CEO David Meinertz as GM of International. The company now has regulatory footing and leadership in place to move quickly post-ZAVA close.

Options activity turns aggressive. One trader bought $328K worth of $85 call options for December, and others grabbed calls at the $55-$60 range—suggesting growing confidence in a big move after earnings next month. At the same time, short interest remains near record highs (~35%), keeping the door open for a potential squeeze.

New short interest data drops… TOMORROW 👀

Technical setup improving. Despite intraday volatility, the stock held $50 into the close and keeps setting higher lows. Bulls are eyeing a breakout above $52 to reopen the gap at $61.

Catalysts

Launch of TRT + menopause

Details about Hims’ new peptide facility

Updates on at-home testing (Trybe Labs)

Updates on Hims’ AI roadmap…

Disclosure of ZAVA acquisition price tag

European expansion updates

Expansion of Gummies into new categories/products?

Any legal filings from Novo Nordisk or Hims

Lingo CGMs or other wearable partnerships?

More acquisitions still to come?

Pharma tariffs?