Stock Price: 58.51

Today: -1.96 (-3.23%)

Past month: +$30.68 (+110.11%)

Past year: +$48.31 (+483.40%)

🚨 LATER THIS WEEK - we’re releasing our Q4 earnings predictions. Just $15/mo or $150/yr. Click “Subscribe Now” for access!

What’s Happening

Shares finally cooled off: HIMS traded down from the low-$60s to around $58 early in the session, then bounced between $58 and $60 for the rest of the day

Institutional ownership updates:

ICONIQ has taken a $70M stake: more than 1% of HIMS and ICONIQ's 12th largest position

Farallon Capital Management bought more than 8M shares of HIMS in Q4: a nearly 4% stake in HIMS and 1% of Farallon's portfolio. Farallon was founded in 1986 and typically holds positions for 2-5 years. Until 2008, Farallon had never experienced a down year

Goldman Sachs increased its position in HIMS to 5.5M shares: a roughly 2.5% stake in HIMS and an increase of 4.5M shares — from 1M to 5.5M

Analyst price target updates:

Morgan Stanley downgraded HIMS from Overweight to Equal Weight (but lifted its price target from $42 to $60), citing the stock’s rapid rise and the possibility of a “breather”

Meanwhile, BTIG raised its PT sharply from $35 to $85, underscoring divergent views on HIMS’s growth potential 🤯

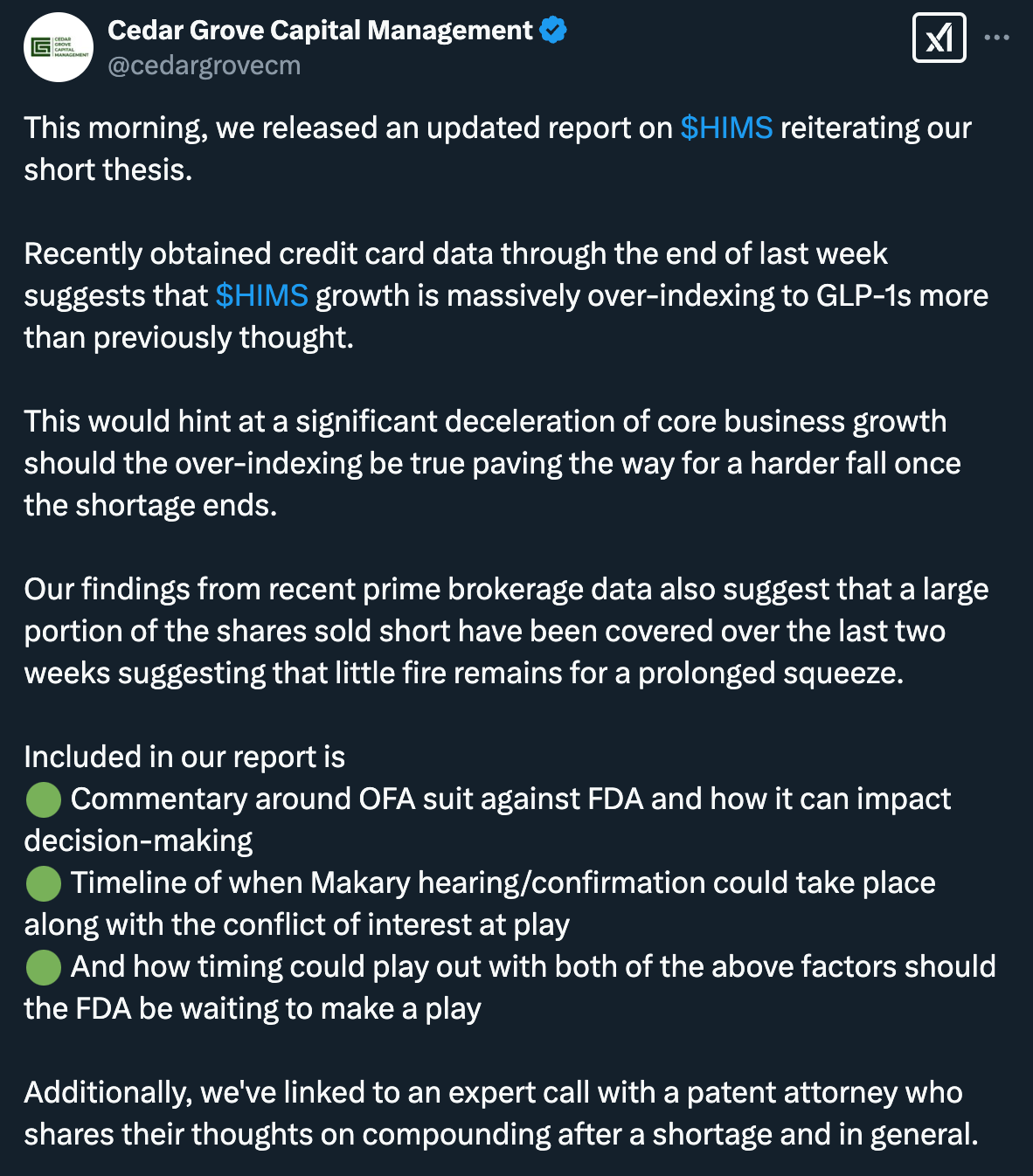

Short-seller scrutiny: Cedar Grove (Paul Cerro) and other bearish voices reiterated concerns that HIMS’s growth might be overly concentrated in weight loss offerings (notably GLP-1 compounds). Bulls counter that the company’s broader product lineup and large recurring customer base will weather the storm once semaglutide goes off shortage (still TBD when that happens)

Investors debate capital-raise potential: Speculation arose in the Discord about whether HIMS might tap markets for additional cash to pursue more aggressive expansion and possible acquisitions. Supporters say the company’s cash-positive position lessens the need to dilute shares, though some shareholders would welcome further M&A moves.

Catalysts

T-6 days until Q4 earnings

FDA decisions on semaglutide + tirzepatide

Greenland / Trump tariffs

HIMS to appear at Morgan Stanley’s Technology, Media & Telecom Conference in March

S&P MidCap 400 potential inclusion on March 21?